2026 Legislative Session:

What GSBA Members Need to Know

By Gabriel Neuman, Esq. (he/him), Director of Policy & Advocacy

Happy New Year, GSBA community!

With just a few days before the Washington State Legislature convenes, I wanted to share a quick overview of what to expect this session, prepared in partnership with our fantastic lobby team — Katie Kolan, Jean Leonard, and Annie McGraff. This will be a fast 60-day short session, and there’s quite a bit already in motion. Here’s what GSBA members should know:

Session Snapshot

The 2026 Washington State Legislative Session begins Monday, January 12 — the earliest start allowed under the Washington State Constitution. This is year two of the 2025–27 biennial cycle, which means lawmakers will focus on refining existing work rather than building major new packages from scratch. Expect action on:

- 🟦 Supplemental operating, capital, and transportation budgets

- 🟦 Bills that survived last year but didn’t advance

- 🟦 Newly introduced legislation, much of which is already beginning to drop

While the short timeline creates natural limits on what can move, the pace is traditionally fast, dense, and highly compressed.

Political Landscape

Democrats continue to hold the Governor’s Office and both legislative chambers, maintaining a full trifecta. Recent elections favored more progressive Democrats, giving the caucus strong influence over:

- 🟦 Which bills receive hearings

- 🟦 Which proposals advance

- 🟦 Which fiscal items survive the negotiation process

As always, committee hearings are the gatekeepers. If a bill isn’t scheduled for a hearing before cutoff, it generally doesn’t move — though, as we like to say, no bill is truly dead until Sine Die.

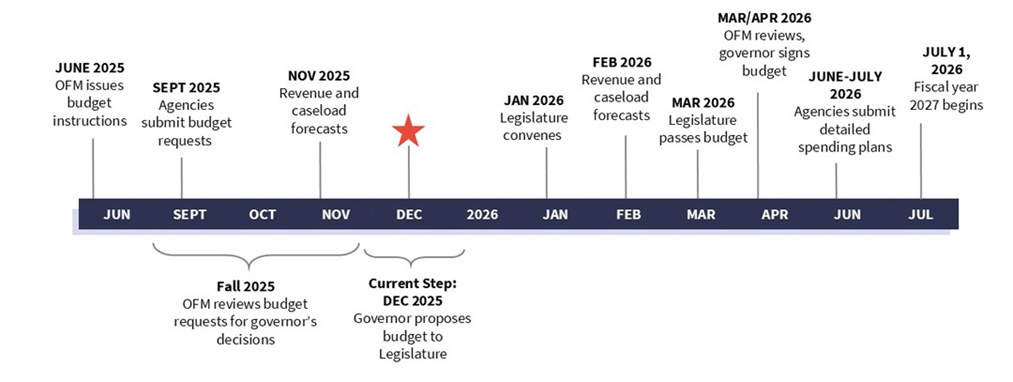

Budget Context

Because we’re in year two of the biennium, lawmakers will be crafting supplemental budgets rather than full two-year plans. But the fiscal environment is going to define much of the session.

Washington enters 2026 with a budget deficit. Last year, the Legislature grappled with a $12–14 billion gap, approving $9 billion in revenue increases and a mix of cuts. We expect:

- 🟦 More revenue proposals

- 🟦 Additional cuts

- 🟦 Very little appetite for bills that carry any fiscal note

Anything with a cost attached is being described as “DOA.”

Governor Ferguson’s Supplemental Budget

The Governor released his proposed supplemental budgets on December 23. These proposals:

- 🟦 Increase the overall biennial budget from $77.8B to about $79B (a ~1.5% increase)

- 🟦 Attribute $885M of that increase to unavoidable cost pressures such as caseload growth and inflation

- 🟦 Include $800M in reductions to help close a projected $2.3B shortfall in the four-year outlook for FY29

- 🟦 Signal a willingness from Gov. Ferguson to veto tax proposals he views as non-viable

Key Highlights

- Department of Commerce: Reductions across grants supporting manufacturing, microenterprise, violence prevention, dispute resolution centers, broadband action planning, growth management planning, and federal tax incentive capacity.

Total reduction: –$16.7M - Governor’s Office: A 2% reduction, including cuts to the Office of Equity.

Total reduction: –$1M

Looking Ahead

We will continue to monitor bill introductions, committee activity, and budget developments closely as the session approaches and gets underway.

As always, I’m here to support our members. Please reach out any time if you have questions about specific policy areas, emerging legislation, or how these proposals may affect your business or community.

It’s a privilege to represent you in Olympia. More updates coming very soon.

— Gabriel Neuman, Esq.

Director of Policy & Advocacy, GSBA