GSBA Policy Newsletter – September 2025

Written by Gabriel Neuman (he/him), Policy Counsel & Government Relations Manager

September Advocacy brought to you by:

Fall is here, and with it comes a wave of policy changes and ballot measures that will shape the future of doing business in Seattle and across Washington State. From new taxes taking effect October 1, to a B&O tax proposal headed to voters this November, to deeply concerning anti-LGBTQ+ ballot initiatives, there is much at stake for our businesses and our communities.

At GSBA, our role is to make sure you have the information you need to stay ahead of these changes, and that your voices are represented where decisions are being made. We’re also preparing to host a webinar with the Department of Revenue to dive deeper into the new taxation rules—details coming soon.

New Taxes & Department of Revenue Guidance

The 2025 Washington State Legislature passed Engrossed Substitute Bill 5814, which subjects additional businesses to the state’s retail tax. Starting October 1, 2025, the following industries will be required to begin collecting sales tax on services:

- Advertising services

- Live presentations

- Information technology services

- Custom website development services

- Investigation, security, and armored car services

- Temporary staffing services

- Sales of custom software and customization of prewritten software

Department of Revenue Guidance

Guidance now available for:

- Custom Website Development

- DAS Exclusions

- Existing Contracts

- IT Services

- Live Presentations

- Security Services

Guidance still pending for:

- Advertising Services

- Custom Software

- Temporary Staffing

GSBA will be co-hosting a webinar with the Department of Revenue to walk through these changes and answer your questions. Details will be shared soon.

Image: The Urbanist

“The Seattle Shield Initiative is going to voters in November following unanimous approval at City Council on Monday. Facing a tough challenge from the left, Mayor Bruce Harrell quickly signed the bill after the vote. (Ryan Packer)”

Seattle City Council Adopts Business & Occupation Tax Proposal

Seattle City Council voted to send a Business & Occupation (B&O) tax proposal to a public vote on the November ballot. The proposal includes:

- Raising the small business exemption threshold from $100,000 to $2 million

- Creating a new $2 million standard deduction

- Increasing B&O tax rates for larger businesses

Rate Changes

- Retail, wholesale trade, manufacturing, extracting, printing & publishing: 0.342% through Dec 31, 2032 → 0.273% thereafter

- Services, other, and transport for hire: 0.658% through Dec 31, 2032 → 0.526% thereafter

The City estimates that businesses with gross sales above $5.7 million will see higher obligations even after deductions.

GSBA supports the relief for small businesses but has cautioned the City to consider the impacts on medium and large businesses, particularly in downtown. Read our full statement

here.

New interim guidance available for ESSB 5814

To support the implementation of Engrossed Substitute Senate Bill (ESSB) 5814, we are publishing a series of Interim Guidance Statements (IGSs) clarifying the upcoming retail sales tax changes effective Oct. 1, 2025. Taxpayers can rely on interim guidance until we issue final or permanent guidance, or cancel the interim guidance.

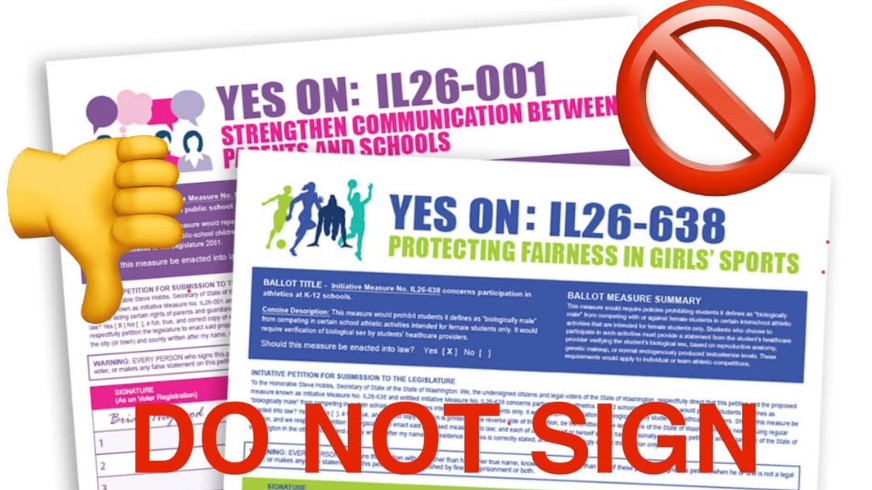

Anti-LGBTQ+ Ballot Initiatives Announced

The conservative group Let’s Go Washington has filed two initiatives aimed at undermining LGBTQ+ protections:

- Repealing the Safety Act – rolling back privacy protections for students, forcing educators to disclose sensitive personal information, including discussions on gender identity or reports of abuse at home.

- Banning Trans Girls from Sports – requiring invasive medical procedures before female athletes are allowed to participate.

In response, Washington Families for Freedom, a statewide coalition that includes GSBA, Gender Justice League, ACLU, Pro Choice Washington, and others, has launched a campaign to defeat these harmful measures. Learn how to support on their website.

New Seattle Revenue Forecast

- Nationally: Probability of recession lowered from 40–50% to 33%; tariffs have not yet driven significant price increases; layoffs remain stable.

- Locally: Employment in King and Snohomish Counties down 0.1% in early 2025 vs. 2024; biggest declines: construction, manufacturing, finance.

- Outlook: Forecast anticipates the Federal Reserve will cut rates this fall, supporting modest recovery.

Seattle still faces a projected $150–176 million deficit in 2027–2028, an improvement from April’s $230m deficit forecast. Read More Here

New Food Safety Proposal from Councilmember Teresa Mosqueda

Councilmember Teresa Mosqueda has introduced a policy to increase oversight of food establishments that have unresolved labor standard violations:

- If a business has an unresolved violation (per WA L&I, AGO, or Seattle OLS), Public Health Inspectors will add a placard alongside the food safety rating noting the increased inspection status.

- The placard can be removed immediately once the violation is remedied or appealed.

📄 Read Mosqueda’s one-pager here.

Closing Thoughts

The policy landscape is moving quickly—and every one of these decisions will have real impacts on our members, our businesses, and our communities. GSBA will continue showing up at the table, advocating for policies that create a more inclusive economy, and pushing back against efforts to strip away rights from LGBTQ+ Washingtonians.

If you have questions, concerns, or want to be more involved in our advocacy efforts, please reach out directly. Together, we can ensure our community’s voice is heard.

In solidarity,

Gabriel Neuman (he/him)

Policy Counsel & Government Relations Manager, GSBA

gabrieln@thegsba.org