By River Teslar, GSBA Business Training Specialist

A new year brings new opportunities to review your payroll practices! Washington’s 2025 overtime rule updates offer a chance to revisit which salaried employees qualify as exempt from overtime, minimum wage, and sick leave protections. While these changes are mandated by Washington State Labor & Industries it’s worth noting that minimum wage and certain ordinances in the city of Seattle vary from state policy. That said, there’s no need to stress—I’m here to walk you through the changes and help you get ahead.

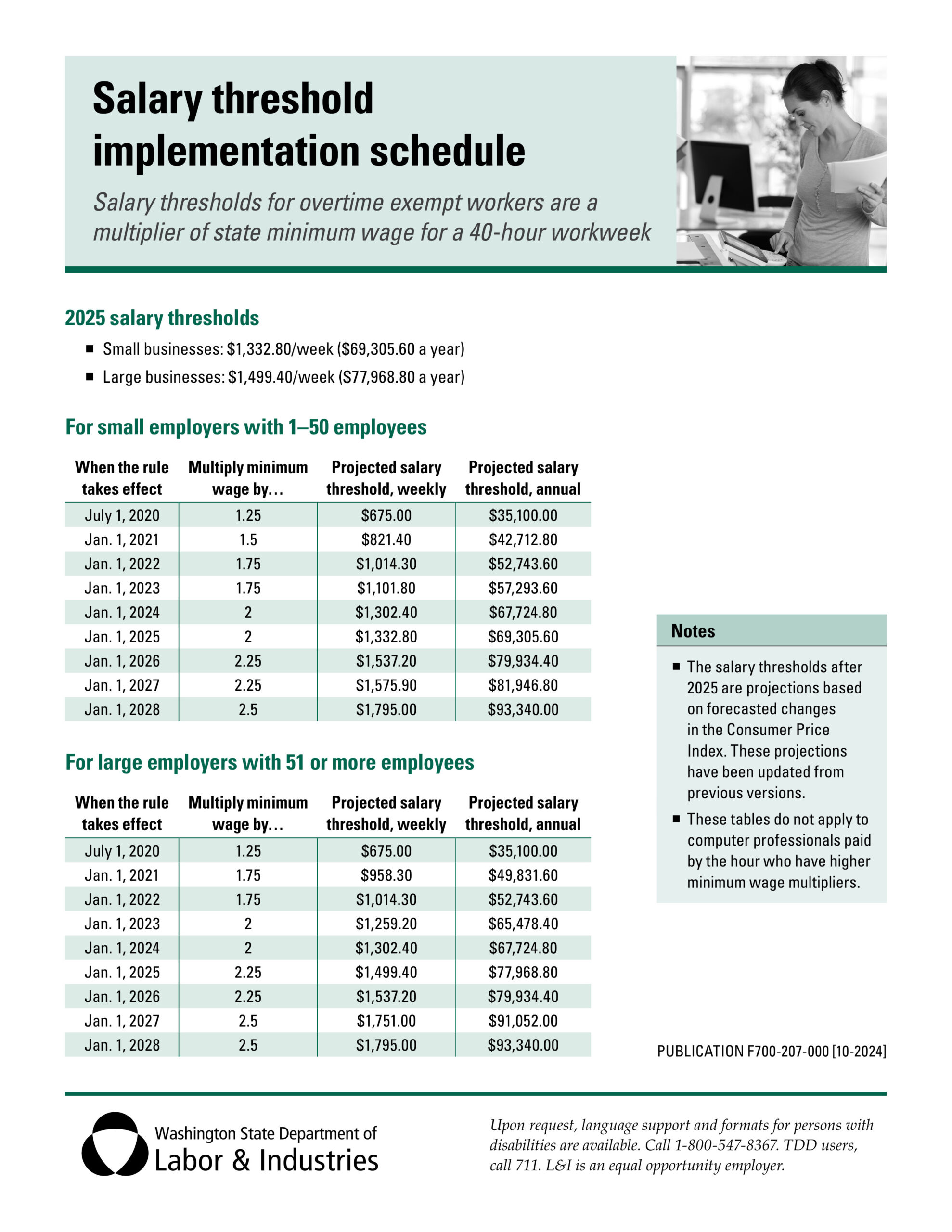

The 2025 Salary Thresholds

According to Washington State Labor & Industries’, starting January 1, 2025, the salary threshold for exempt employees will be:

Small Employers (1–50 employees): $1,332.80 per week ($69,305.60 annually)

Large Employers (51+ employees): $1,499.40 per week ($77,968.80 annually)

This means that salaried employees earning less than these amounts will no longer qualify as exempt, even if their duties align with exempt job categories.

The state’s salary thresholds for exempt workers are tied to Washington’s minimum wage, which is adjusted annually based on inflation. For 2025, the minimum wage will rise again, and the thresholds follow suit. By 2028, the salary threshold will max out at 2.5 times the state minimum wage, so you can expect incremental increases each year until then.

Who’s Affected by the 2025 Overtime Rule Changes?

These rules apply to executive, administrative, and professional (EAP) employees, as well as outside salespeople and computer professionals. To qualify as exempt, workers must:

- Be salaried (not hourly).

- Earn at least the salary threshold.

- Perform duties that fit specific exempt categories under Washington state law.

If an employee doesn’t meet all these criteria, they’re considered non-exempt—and eligible for overtime pay, minimum wage, and other protections.

What Do the 2025 Overtime Rule Changes Mean for Your Business?

If your salaried employees earn less than the new thresholds, you’ll need to make adjustments:

- Increase Their Pay: Bring their salaries up to meet or exceed the new thresholds.

- Reclassify Them as Hourly: Start tracking hours and paying overtime for any work over 40 hours per week.

Remember: Washington’s thresholds are higher than federal requirements, so you’ll need to follow the state rules to remain compliant.

Planning for the Future

The 2025 overtime rule changes are a great chance to ensure your business is compliant and ready for what’s ahead. Think of it as an opportunity to fine-tune your payroll practices while avoiding last-minute headaches.

|

Here’s how to get your business prepared for 2025 and beyond:

|

Need Labor Law Support?

We get it—payroll rules aren’t exactly thrilling, but staying ahead of them is key to running a successful business. Whether you have general compliance questions, or need guidance for planning, reach out to me, River Teslar, for complimentary consultations on Seattle Office of Labor Standard ordinances or Washington State Labor & Industries’ compliance at RiverT@thegsba.org.